mortgage refinance transfer taxes

Real Estate Transfer Taxes in New York - SmartAsset In New York the seller of the property is typically the individual responsible for paying the real estate transfer tax. Real estate mortgage calculator new american funding mortgage calculator mortgage calculator maryland with taxes mortgage rate calculator how to pay off mortgage early calculator.

Pennsylvania Deed Transfer Tax 2022 Rates By County

Should there be a mortgage on the.

. Ad Compare Top Mortgage Refinance Lenders. Generally mortgage interest is tax deductible meaning you can. Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You.

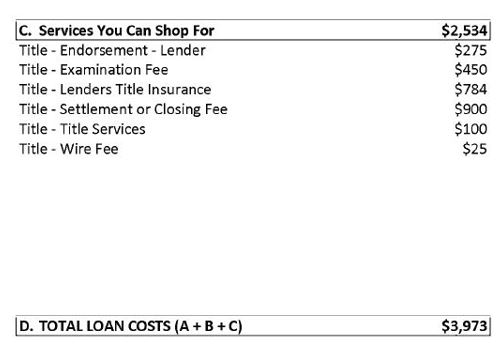

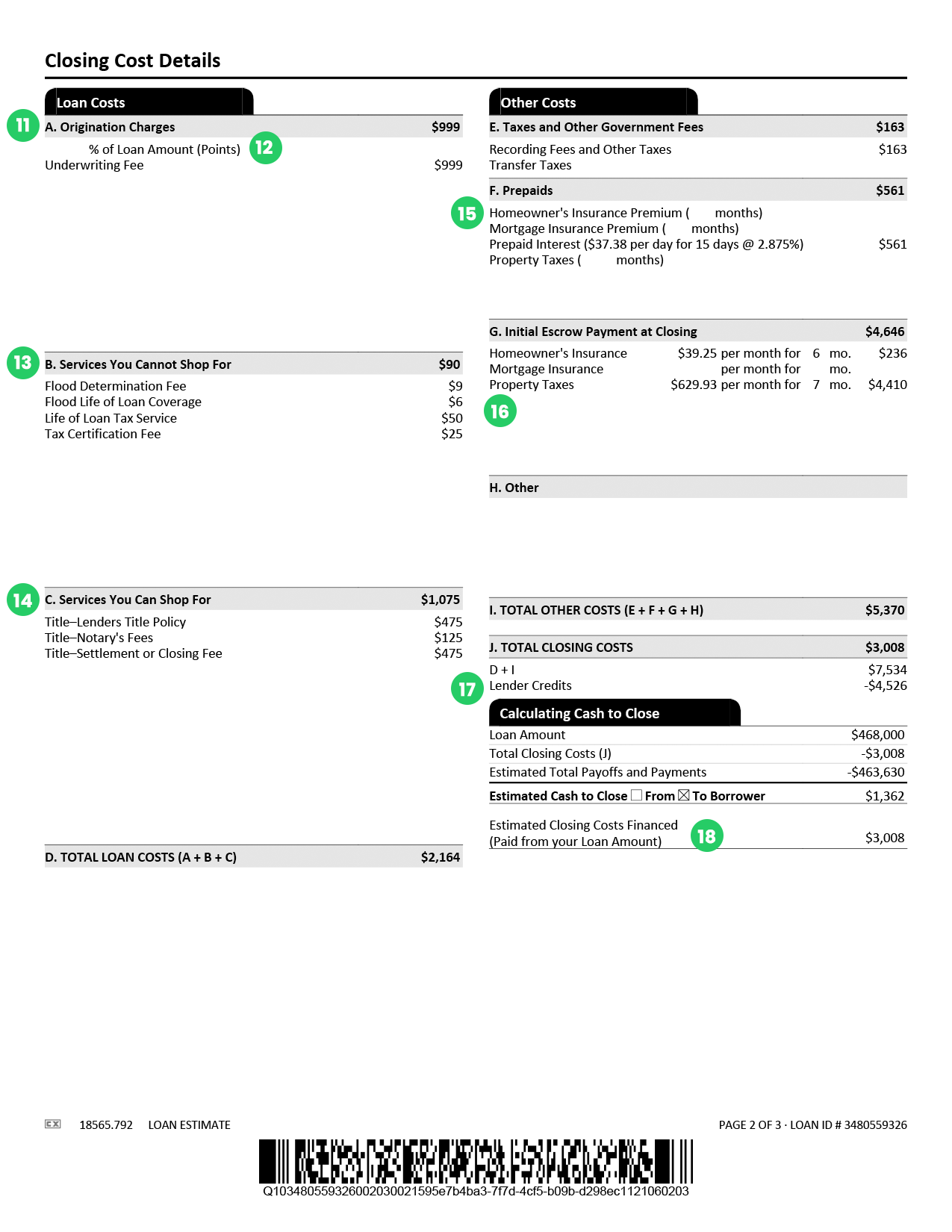

What You Need To Refinance Your Home Mortgage 2021 Closing costs are processing fees you pay to your lender when you close on your loan. Florida Mortgage Refinance Transfer Taxes Oct 2022 Florida Mortgage Refinance Transfer Taxes - If you are looking for lower monthly payments then we can provide you with a plan that. With any mortgageoriginal or refinancedthe biggest tax deduction is usually the interest you pay on the loan.

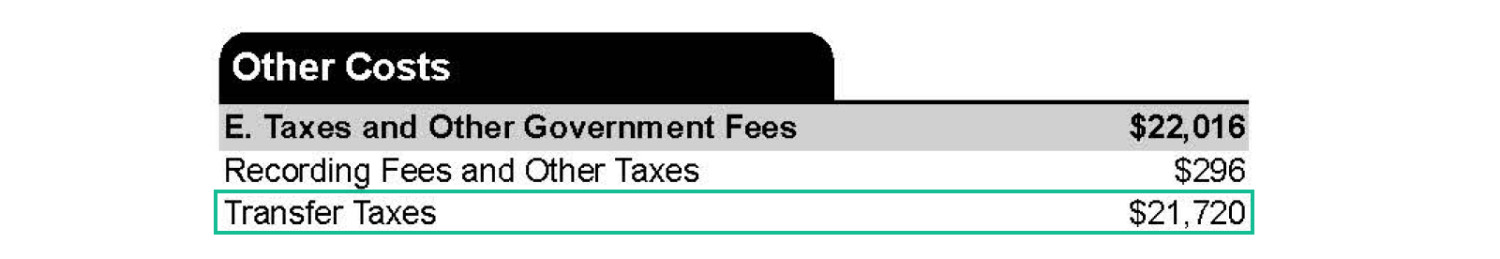

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. The buyer typically pays the state and county deed transfer tax. Including the mansion tax.

52 rows The graphic below shows an example of how transfer tax costs can vary in this case by 2400 depending on your location. View Offers Side by Side. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

In various jurisdictions transfer taxes are also called real estate conveyance taxes mortgage transfer taxes and documentary stamp taxes. Closing costs on a. Apply Get Pre Approved In 24hrs.

In Florida transfer tax is called. A Reverse Mortgage can give you the freedom to live the retirement you always envisioned. Ad Best Mortgage Refinance Compared Reviewed.

A property selling for. An additional tax of. Easily calculate the New Your title insurance rate and NY transfer tax.

Compare Refinance Lenders Based on Whats Important to You. State Transfer Tax is 05 of transaction amount for all counties. Ad Top Refinance Companies Could Help You Save on Your Mortgage.

Ad Our Student Debt Calculator Tools Can Help You Pick A Strategy To Help Pay It Off. Ad Use a Reverse Mortgage to stay in your home reduce monthly payments and free up cash. Basic tax of 50 cents per 100 of mortgage debt or obligation secured.

For conveyances of real property located outside New York City file Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption. In contrast to a property transfer Maryland State law and the County do not require that property taxes must be paid if you refinance your mortgage. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

The seller pays a transfer tax to the state also known as the VA Grantor tax. Some more popular cities tend to charge additional. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

Trusted by 45 million users. Note that transfer tax rates are often. Title insurance rates are regulated by the State of New York therefore title insurance rates will.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. 500 2 is 1000 and that would be what you owe in transfer taxes for the sale.

A real estate transfer tax sometimes called a deed transfer tax is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property. Choose Your Investment Strategy To Help You Navigate Lifes Financial Setbacks. If you sold the property for 250000 you would divide 250000 by 500 which is 500.

Mortgage Refinancing Rates Penfed Credit Union

Understanding Closing Costs Sirva Mortgage

A Ny Homeowner S Guide To Cema Loans Cema Loan Better Better Mortgage

How To Read A Monthly Mortgage Statement Lendingtree

Mortgage Loan Estimate Guide Selfi

Closing Costs What Are They And How Much Rocket Mortgage

Real Estate Transfer Taxes In New York Smartasset

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Mortgage Refinance Process 7 Steps To Refinancing Mint

Cash Out Mortgage Refinance Tax Implications Bankrate

True Costs Of A Reverse Mortgage Loan American Advisors Group

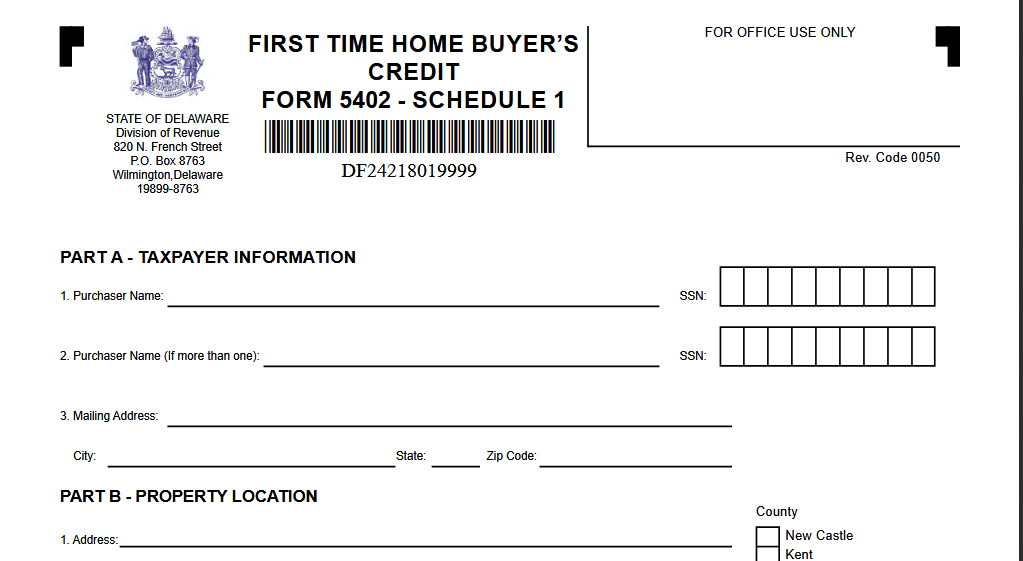

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

Real Estate Transfer Taxes Deeds Com

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Should I Transfer The Title On My Rental Property To An Llc

What Are Closing Costs And How Much Will I Pay

What Is An Apr Annual Percentage Rate Explained Kw Utah Kw Utah